Summary

With a new year fast approaching, Beutel Goodman’s Fixed Income team looks at the lay of the land for bond investors, assessing the prospects for the economy, interest rates and credit spreads in 2025.

By Beutel Goodman Fixed Income Team

“The only certainty is that nothing is certain” – Pliny the Elder, Roman Philosopher

As we approach the end of 2024, a year marked by political upheaval worldwide, there is a lot of uncertainty regarding what new governments will mean for markets and the global economy.

There have been notable shifts in the global economic landscape over the past year, with inflation contained near central banks’ targets, an economic soft landing potentially on the horizon, as well as electoral change happening around the world. At this juncture, it feels as though we are finally turning the page on the post-COVID era. Yet, with change comes uncertainty, and for bond investors, uncertainty can often bring opportunity.

Trends, momentum and liquidity are fickle, and in uncertain markets, an investment process predicated on discipline and fundamental analysis becomes of paramount importance. Despite elevated interest-rate volatility and tight credit spreads (i.e. there is little difference between corporate and government bond yields), we are still finding investment opportunities while preparing for what 2025 may bring.

Assessing the Economic Picture

Canada and the United States are expected to experience similar GDP growth rates in 2025. According to Bloomberg data as of November 2024, real GDP in the U.S. is forecast to expand by 2.7% in 2024, 2.1% in 2025 and 2.0% in 2026, while Canada’s economy is expected to expand by 1.1% in 2024, 1.8% in 2025 and 2.0% in 2026.

There are numerous economic variables baked into these predictions. After the progress made on taming inflation in 2024, the U.S. Federal Reserve (Fed) has started a monetary easing cycle, cutting the Federal Funds Rate by a cumulative 100 bps at its September, November and December meetings. However, robust economic data (particularly labour market data) has caused uncertainty around the timing and magnitude of further cuts.

President-elect Donald Trump’s victory in November 2024 will usher in a new administration in January 2025, and the impact of his policies remains to be seen. Trump is inheriting a delicate economy; the threat of a weakening labour market or inflation re-accelerating remains a real risk for demand and growth. The incoming administration’s proposed taxes and tariffs add to the uncertainty, as economists assess the effect of various anticipated changes. Historically, and since the election, credit markets have responded positively to the prospect of tax reductions with credit spreads tightening. There are long-term concerns over the potential inflationary impact from proposed tariffs, however.

The Canadian economy has also made progress on inflation over 2024, but its growth prospects are more muted than in the U.S. Canada generally has a more indebted consumer, as well as a housing market that is more exposed to interest rate risk. While the Bank of Canada (BoC) has eased monetary policy by a cumulative 175 bps over five meetings beginning in June 2024, the central bank is mindful of the decline in the loonie due to its divergent monetary policy relative to the U.S. As of November 30, 2024, the Canadian dollar has depreciated approximately 5% year to date and is approaching $0.70 CAD/USD. While some deviation in monetary policy between Canada and the U.S. will be tolerated, the BoC will likely be mindful of the potential for the value of the Canadian dollar to continue to fall when setting its overnight rate.

Fixed Income Markets

We believe both the Fed and the BoC are likely to continue their easing cycles over the near term. In the interest rate space, the market is currently pricing in a terminal rate (i.e., the level at which central banks end their cutting cycle) of approximately 3.50%-3.75% in the U.S. and 2.50% in Canada. While we broadly consider the market’s terminal pricing in the U.S. to be appropriate, we believe the economic situation in Canada is weaker, and could warrant further easing beyond what the market is currently pricing in. If the Canadian economy slows further, the BoC may be inclined to cut rates below their assessment of neutral (currently considered to be ~2.75%), which could lead to a decline in bond yields across the interest rate curve.

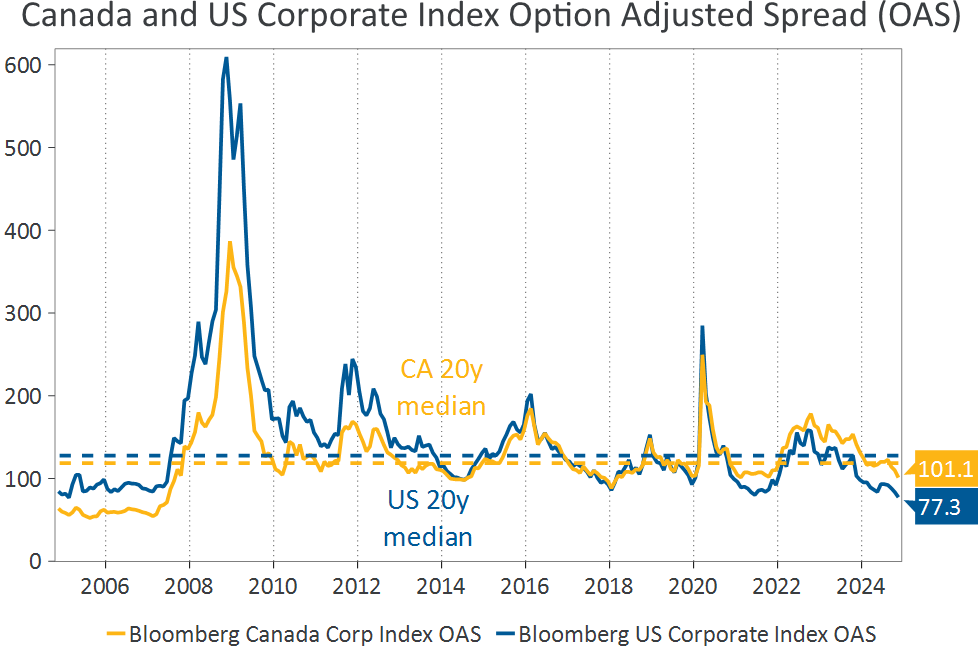

In the credit space, spreads tightened in both the Canadian and the U.S. markets throughout 2024, without any material periods of pronounced investor caution (risk-off periods). Generally, the wider the spread, the greater the compensation demanded for holding the debt of the company. Riskier companies typically trade at a higher spread and less risky companies at a lower spread. Spreads can also change given the prevailing market conditions. In 2024, spreads have decreased year to date by 30 bps in Canada and 25 bps in the U.S. and are currently sitting at historically tight levels (Exhibit 1).

Exhibit 1. U.S. and Canada: Historical Corporate Spreads. This line graph shows corporate spreads in both the U.S. and Canada from the end of 2003 to November 29, 2024. There are two dotted lines representing the long-term (20-year) median spreads. The yellow dotted line is the 20-year median spread in Canada (represented by the Bloomberg Canada Corporate Index OAS), which sits at 118 bps, while the blue line is the median spread in the U.S. (represented by the Bloomberg U.S. Corporate Index OAS), which sits as 128 bps. Spreads at November 29, 2024 were 101 bps in Canada and 77 bps in the U.S, below the 20-year median. The tight spread levels at the end of 2024 indicate that bond markets believe there is less risk of a recession in the U.S. and Canada.

Source: Beutel, Goodman & Company Ltd., Bloomberg, as at November 29, 2024

With central banks having seemingly tamed inflation, the path for credit spreads in 2025 will be determined by the macro backdrop, and more specifically, the strength of the labour market and geopolitics as the new administration in the U.S. enacts its own economic policies. We are currently in a global monetary policy easing cycle; all else being equal, this environment would be conducive for credit/corporate spreads moving tighter.

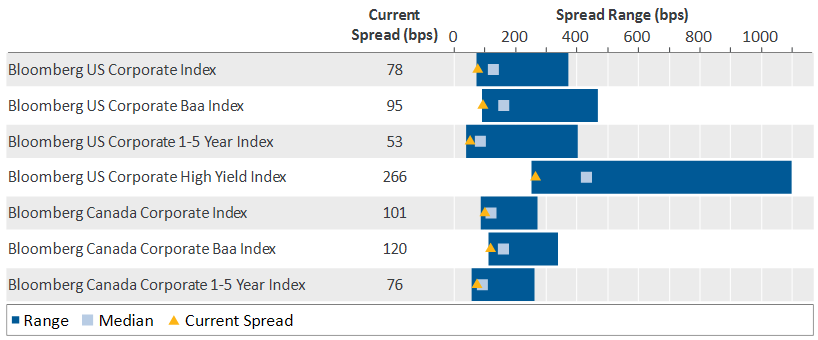

However, given the already tight corporate spread levels (see Exhibit 2) it is less likely that spreads will continue to tighten much further. Attractive all-in yields, inflows into the asset class, and continued economic growth all would ordinarily be tailwinds for credit spreads. However, history suggests a low probability of incremental tightening from current levels, so we expect credit returns for the next year may be modest.

Exhibit 2. U.S. and Canada: Historical Corporate Spreads over 15 years. This chart shows corporate (credit) spread levels in the U.S. and Canada since 2009. Using the 15-year period from November 2009 to November 2024, current spread levels are close to their tightest levels for any time during that period.

Source: Beutel, Goodman & Company Ltd., Bloomberg, as at November 29, 2024

Truffle Hunting: Finding Opportunities in Fixed Income

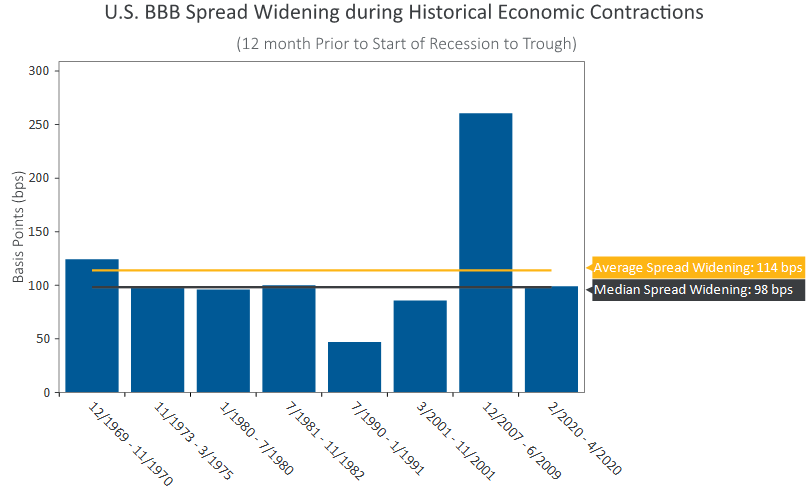

There are still pockets of attractive relative value in fixed income. Being invested in 1- to 5-year credit currently offers a more attractive risk-reward proposition versus mid- and long-duration credit. Short duration acts as protection against spread widening and/or rate volatility, while also offering an attractive yield. However, there remains a real possibility of a market correction and economic downturn in 2025. Geopolitics, U.S. fiscal policies, a credit event and/or a shift away from the U.S. achieving a soft economic landing all could lead to a widening of credit spreads. Additionally, Canada is more at risk of a recession in 2025.

As shown in Exhibit 3, in past recessions, BBB spreads widened by an average of 114 bps; BBB-rated bonds are typically the most volatile type of investment grade bonds and have more variety in sectors and issuers, making them a good representation of overall credit risk. In times of spread widening, short credit is very defensive given the lower duration. Short credit is generally also more liquid and easier to sell amidst volatility. Short credit is a key component of our defensive positioning against a recession and spread widening, as we believe it offers good average yield and can be quickly recycled into more attractive credit opportunities.

Exhibit 3. Spread Movement During Previous Contractions. This chart shows U.S. BBB spreads during different U.S. recessionary periods since the late 1960s. The spreads for lower-rated corporate bonds typically widen during an economic downturn, with an average spread widening of 114 bps during the ~40-year period depicted here. The Global Financial Crisis was the outlier, with spread widening for BBB bonds exceeding 250 bps during that recession.

Source: Beutel, Goodman & Company Ltd., NBER (National Bureau of Economic Research), as at November 29, 2024

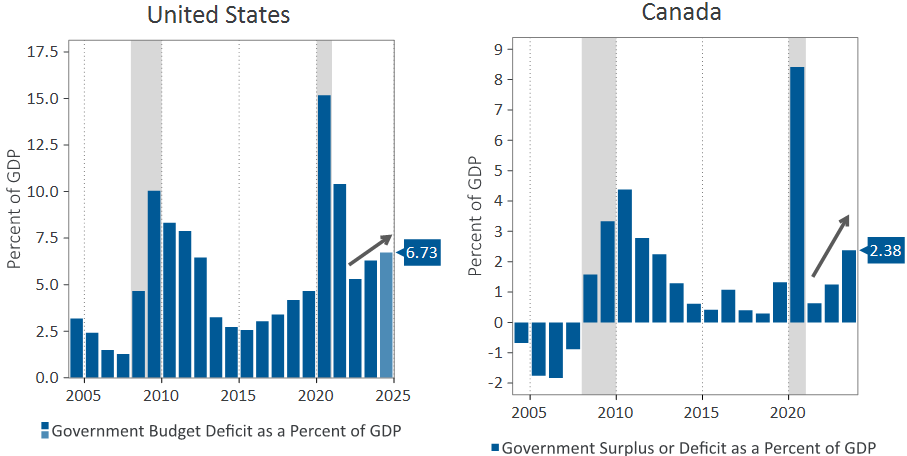

The current investment landscape is unique in that central banks in the U.S. and Canada are trying to keep inflation in check and orchestrate a soft landing for the economy, but given the poor state of government operating budgets, markets and investors are less likely to be able to count on fiscal stimulus to help the economy grow (see Exhibit 4). Looking at the U.S. specifically, the Treasury is running a budget deficit (as a percentage of nominal GDP) of 7%. The U.S. has rarely seen this level of fiscal stimulus and never in non-recessionary times. Canada is in a similar position, although the current fiscal deficit is not as severe as it is in the U.S., nor is the level an outlier in a historical context. Sustained fiscal support is a delicate balance; it can spur growth and consumer demand, but it can also lead to volatility as markets digest what further fiscal support implies for government debt issuance.

We are looking for potential opportunities in the interest rate market — new supply from the U.S. or Canada could pressure yields higher in longer term bonds as the market demands a higher term premium or compensation for holding long bonds.

Exhibit 4. U.S. and Canada Deficit by Quarter and Level. These charts show government debt levels in the U.S. and Canada since 2002. The government deficit as percentage of GDP level is much higher in the U.S. than in Canada after peaking for both countries during the COVID-19 pandemic. Grey = recession indicator. The light blue bar in U.S. chart is the U.S. Congressional Budget Office (CBO) estimate for 2024; this data isn’t yet available for Canada.

Sources: Beutel, Goodman & Company Ltd., U.S. Congressional Budget Office (CBO), Macrobond, Statistics Canada, as at November 29, 2024.

Defensive Positioning

The market is driven by different narratives. Heading into 2025, the prevailing narrative for investors is one of optimism. Investors are expecting the U.S. to achieve a soft economic landing and are waiting for the new Trump administration policies. However, in the face of the market buoyancy, we at Beutel Goodman remind ourselves to focus on objective valuations in both the credit and interest rate space.

Given the tight level of credit spreads, our fixed income portfolios are positioned defensively, holding mostly higher-rated credit, with a bias towards less cyclical sectors. However, we are prepared to change positioning should spreads move wider and opportunities arise to add higher-beta credit with the potential for higher returns. Our current holdings of higher-beta investment grade and high yield credits are primarily in the front end of the curve. This has the general effect of increasing the average yield of our fixed income portfolios, while not materially increasing the credit duration or risk. We hold a number of “rising-stars candidates”, which are high yield issuers that we expect to be upgraded to investment grade in the near future. We have maintained exposure to these high yield issuers throughout the credit cycle because the upgrade to investment grade generally leads to tighter credit spreads and outperformance for those issuers.

With respect to interest rates, we aim to take advantage of elevated volatility by identifying opportunities and evaluating when gaps emerge between market pricing and our assessment of fundamental value. We are also prepared for a steepening of the yield curve that may result from further easing of policy rates, or from a potential sell-off in long-term rates due to the fiscal backdrop.

As we close the chapter on 2024, our portfolios remain positioned to quickly take advantage of shifting narratives and navigate the uncertain landscape of 2025.

Download PDF

Related Topics and Links of Interest:

©2024 Beutel, Goodman & Company Ltd. Do not sell or modify this document without the prior written consent of Beutel, Goodman & Company Ltd. This commentary represents the views of Beutel, Goodman & Company Ltd. as at the date indicated.

This document is not intended, and should not be relied upon, to provide legal, financial, accounting, tax, investment or other advice.

Certain portions of this report may contain forward-looking statements. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” and other similar forward-looking expressions. In addition, any statement that may be made concerning future performance, strategies or prospects, and possible future action, is also forward-looking statement. Forward-looking statements are based on current expectations and forecasts about future events and are inherently subject to, among other things, risks, uncertainties and assumptions which could cause actual events, results, performance or prospects to be incorrect or to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and assumptions include, but are not limited to, general economic, political and market factors, domestic and international, interest and foreign exchange rates, equity and capital markets, business competition, technological change, changes in government regulations, unexpected judicial or regulatory proceedings, and catastrophic events. This list of important factors is not exhaustive. Please consider these and other factors carefully before making any investment decisions and avoid placing undue reliance on forward-looking statements Beutel Goodman has no specific intention of updating any forward-looking statements whether as a result of new information, future events or otherwise.